Are GLP-1 Drugs Affecting Your Snack Aisle?

A recent article in The Wall Street Journal reported something we haven’t seen in years: snack sales are down. Major brands like PepsiCo’s Frito-Lay and Campbell’s are seeing declines in categories that used to deliver steady growth. It’s not just a blip—it’s a signal.

At the same time, PepsiCo has been quietly investing in brands like Siete, which focuses on grain-free and better-for-you snacks, and more recently Poppi, a prebiotic soda positioned as a healthier alternative to traditional soft drinks.

These moves suggest a clear reality: consumer preferences are shifting, and the biggest players are trying to stay ahead of the curve.

What’s behind the change?

The article points to GLP-1 weight-loss drugs like Ozempic and Wegovy, which suppress appetite and reduce impulsive eating. But the truth is likely more nuanced—and more important to understand.

The shift in behavior is likely being driven by multiple overlapping forces:

- Lower-income consumers cutting back on discretionary purchases due to inflation and economic pressure.

- Higher-income shoppers making gradual changes to their eating habits in pursuit of health and wellness.

- GLP-1 users, whose reduced hunger is quietly altering purchasing patterns.

These forces may look similar in your top-line numbers—lower snack sales, fewer foodservice add-ons—but their underlying causes are very different. And if you’re not measuring at a granular level, you won’t know what’s really driving the shift—or how to respond.

So the key question becomes: Do you have the data to detect which of these trends are affecting your business?

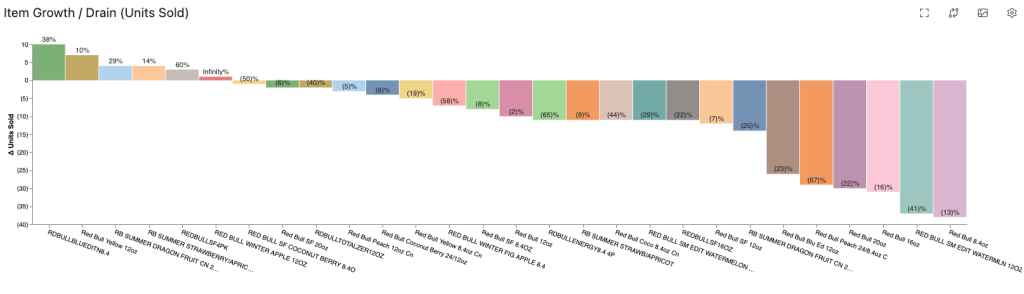

And if PepsiCo is betting on emerging health-forward brands like Poppi, the follow-up is: Will these products work in your stores—with your customers?

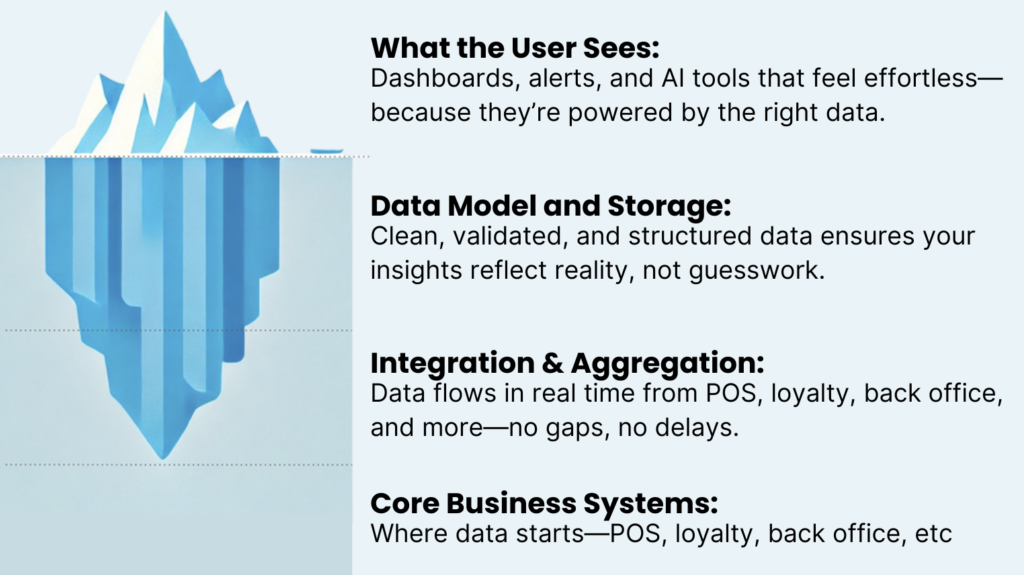

Most organizations aren’t equipped to answer these questions. Without connected data across POS systems, loyalty programs, transaction history, and customer segments, it’s nearly impossible to isolate patterns or test assumptions.

You might see that sales are down—but:

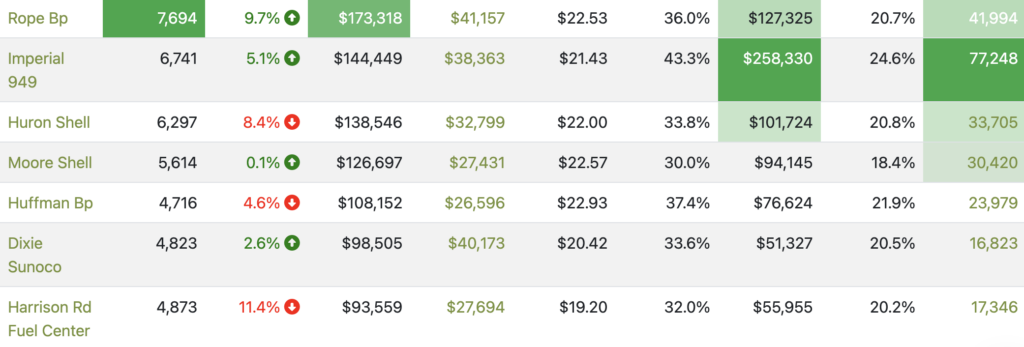

- Is the dip broad-based, or focused in specific stores or regions?

- Is it impacting your core customers, or those who shop less frequently?

- Is it a matter of fewer trips, smaller baskets, or shifting category preferences?

In other words: Are you seeing signals—or just noise?

This is where data readiness becomes a strategic advantage. You need systems that allow you to segment customers, detect behavioral changes in real time, and test how new products like Poppi perform in specific cohorts. What works for a wellness-focused loyalty member in Austin may not land with a price-sensitive commuter in Toledo.

The Bottom Line

Your customers are already telling you what’s changing—just not with their words. They’re doing it through their behavior, and it’s embedded in your data.

If you want to navigate this moment, it’s not enough to watch the headlines.

You need the tools to read your own story.

So ask yourself:

- Are you ready to test how health-forward brands will perform in your environment?

- Can you detect whether behavior is changing because of price sensitivity, wellness trends, or medication use?

- Are your teams equipped to act quickly on what your data is already telling you?

The snack aisle may be changing. Are you ready to change with it?