A Front Office Platform vs. An Accounting System

When I introduce prospects to Taiga’s Front Office Platform, it is not unusual for them to tell me that their accounting system already does that. In these instances, we go deeper into how business intelligence is different from the back office accounting system and how it delivers tangible value to the business. Because this question has surfaced so frequently, I thought I would share an analogy that we use to help illustrate how business intelligence differs from the accounting system.

Accounting Systems Are Like Paper Maps

I may be dating myself here, but many of you may remember the days when we used paper maps for navigation and directions. I used to go on sales trips with 3-4 stops per day for three days in a row. Almost every day, I would get lost at some point. I would be scrambling to read the map and get back on track to try to make it on time. Most of the time, I made it to the meetings. But there is nothing worse than starting off your presentation by apologizing for arriving 15 minutes late.

How Great are Google Maps or Waze?

About 20 years ago, GPS based navigation systems began to flood the market. MapQuest and Garmin introduced navigation systems first but eventually Google Maps won the market. Now anytime I don’t know exactly where to go, I punch the address in and it automatically selects the fastest route. The system processes real-time data to avoid traffic jams caused by an accident or road work. Disruptors like Waze have even launched capabilities that will warn you before you drive into a speed trap. The beauty of these systems is how dynamic they are. If you make a wrong turn, no problem! The system is incredibly flexible and will immediately recalculate to keep you on the fastest route to your destination.

So to summarize this analogy, managing your convenience store chain with just your accounting system and without a Front Office Platform is like driving with paper maps. You can do it, but your opponents – the big chains – will keep earning 2x more sales per square foot than you because they have the instrument panel.

Here are some of the things a Front Office Platform does that a back-office accounting system can’t:

System Independence

Most convenience store chains buy and sell stores. The big chains can afford to tear out all the equipment in stores they buy, forcing standardization of systems. This makes it affordable for them to build their equivalent to a Front Office Platform (their instrument display) because they can count on everything being the same, store to store.

Smaller chains have a different advantage. Since they don’t rely on standardization, they can buy and sell stores equipped with a variety of systems. They are not rigidly stuck with, for example, one kind of accounting system. This means they can begin operating new stores very quickly without painful system installations. The only problem is, until now, they couldn’t have an instrument display. It would be too hard to create systems that interface to all the different systems and devices that might be installed in their new stores. But Taiga’s Front Office Platform interfaces to all the variations. So now mid-sized and small chains can keep their advantage of being flexible on system types and still have an instrument display like the big chains.

ALL the Data

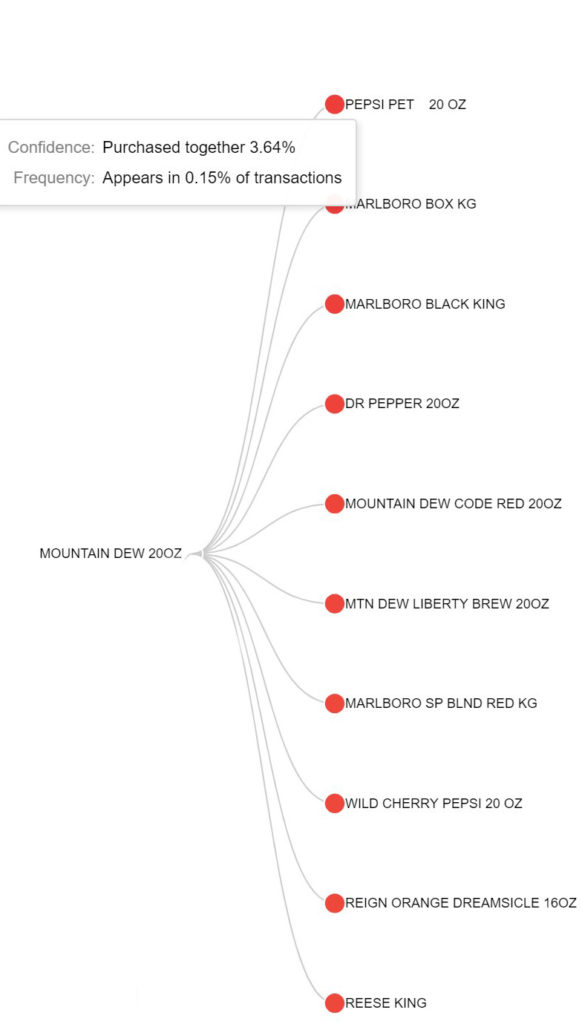

It’s true that accounting systems collect a lot of data and do a lot of processing to produce end-of-month accounting results, etc. I’m not suggesting that you do without an accounting system. But not all the data is captured in accounting systems. Some examples: a) electronic signage pricing; b) outages of gas dispensers; c) suspicious point of sale transactions; d) purchases inside related to gas purchases; e) transactions from all the point of sale systems, including pumps, retail, etc., even if those point of sale systems are from a variety of vendors. A Front Office Platform interfaces to ALL the data regardless of vendor, software release or device type.

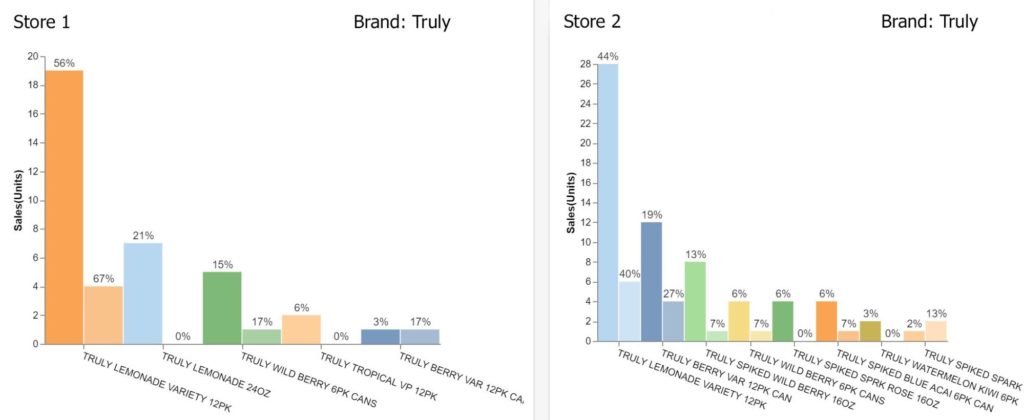

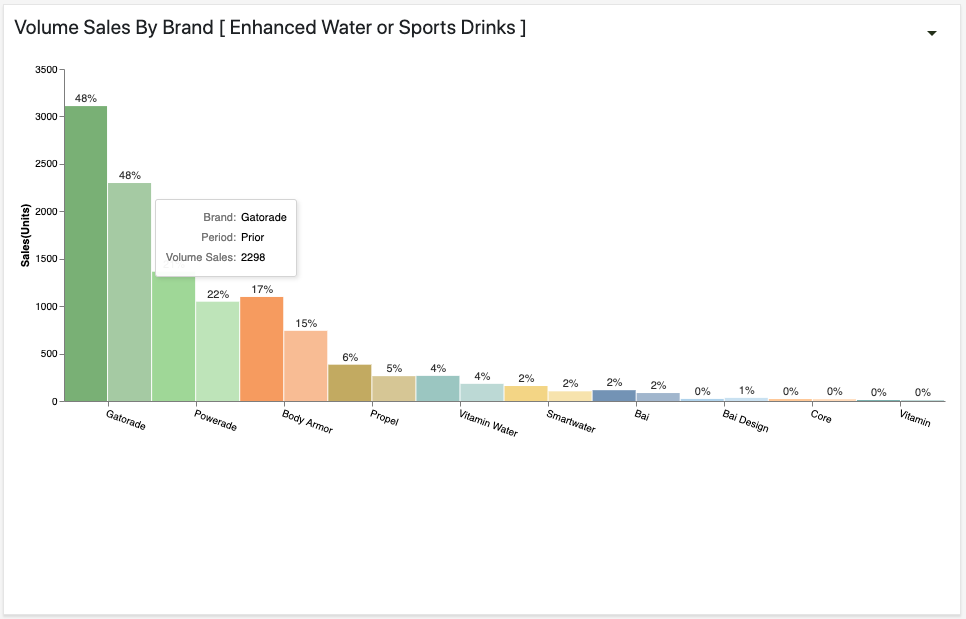

Headquarters Data with Common Categorization

What good is having all the data if you can’t get it to headquarters in a form that lets you compare one store to another or one vendor to another? This requires that all the SKUs from multiple vendors are categorized into a standard system. Taiga’s Front Office Platform automatically makes this transformation. Even if there are three types of accounting systems and nine types of point of sale systems in a mix of 21 stores. And next week you can add another store.

Real Time Data Collection

It wouldn’t be a very useful GPS if all the traffic data was a week or a month old, would it?

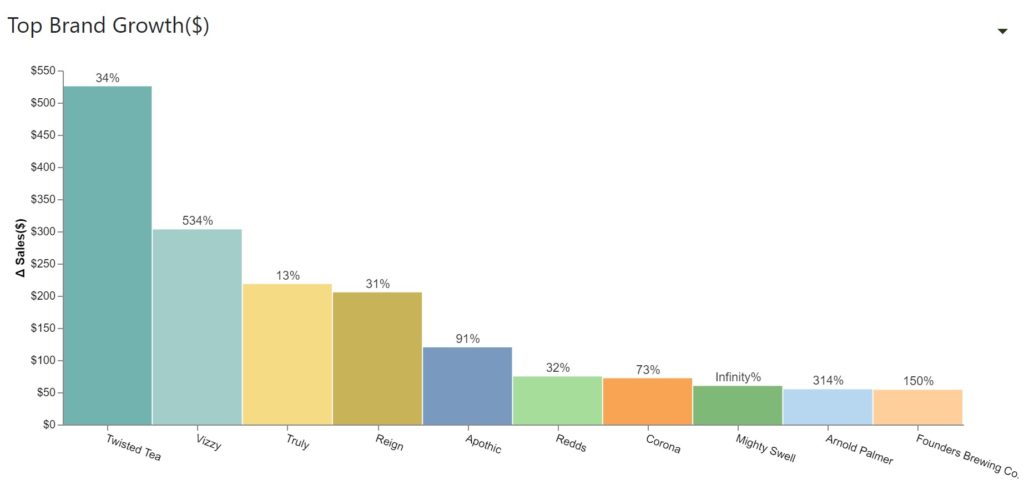

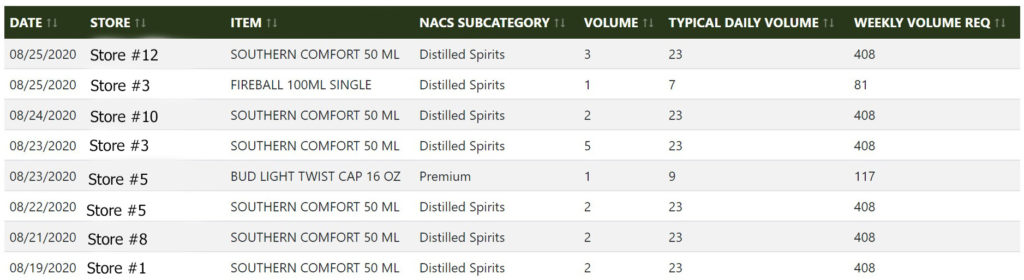

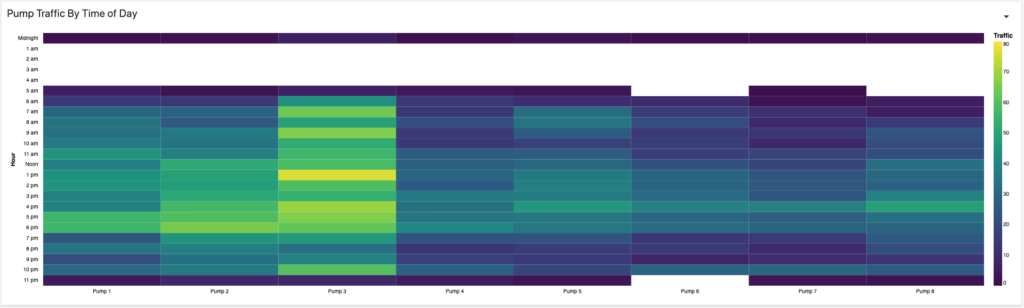

If you want to take action that results in more profits, you need to see the data immediately. You want to know right away if a pump isn’t accepting credit cards. If you’ve run out of milk in the Cheviot Avenue store. You want to know that the beverage vendor just tried to unload his unused inventory of a certain seltzer on you. Especially if you can see on your display that seltzer is not selling in any of your stores. Furthermore you want this information at the central office or even in your car on your phone – now.

Accounting systems are not built to deliver information in real time. They shouldn’t be. They require the exactness of regular closings at the end of accounting periods. But when you are making money-saving decisions in real time, you can’t wait for the period to close. You need a live instrument display. With reports that are current as of 60 seconds ago. And you need them now!

Real Time Alerts

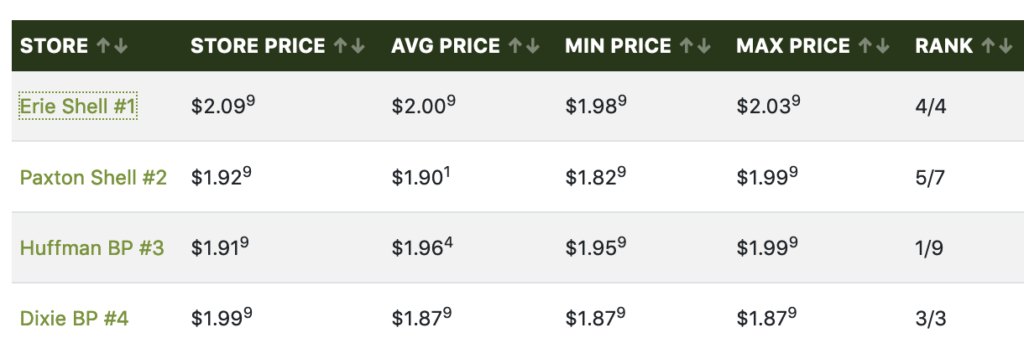

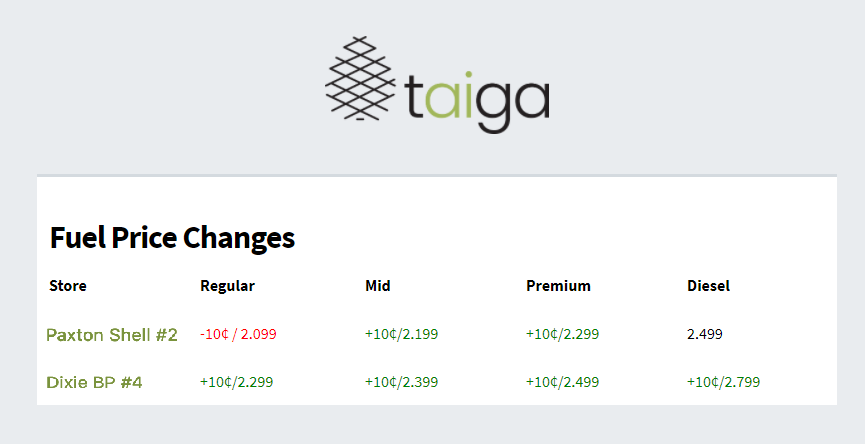

Once Taiga’s Front Office Platform begins collecting data in real time, an interesting new capability emerges. The computer can predict which things you need to know and alert you in real time. In a fighter jet you might hear the awful alarm indicating a missile is homing in on you and a picture on the panel showing you where it is. A Front Office Platform will alert you to all of the following: item shortages, equipment failures, lack of inventory to fill out popular shopping baskets, poor gas pump flow rates, pricing signage that doesn’t match actual pricing, gas pricing that is out of line with the neighborhood pricing, odd transactions that might be employee theft, etc. All the data from all your stores can drive similar alerts to headquarters. These real-time alerts solve lots of problems before they become important.

A Front Office Platform Is Not Another Accounting System

So, the next time you are about to dismiss a Front Office Platform as just another souped-up accounting system, do me a favor. Remember that a Front Office Platform is not an accounting system. It’s the real-time heads-up GPS that lets you drive profits like the big chains.

Vendor Contract Renewals

Vendor Contract Renewals

Loyalty Programs

Loyalty Programs

Pricing Optimization

Pricing Optimization