Solving “The Big Data Problem” in Convenience Chains

Solving “The Big Data Problem” in Convenience Chains

NACS Magazine kicked off 2022 by centering their January issue around Artificial Intelligence (AI) and the potential for this technology to be adopted by the convenience industry. Most retailers know AI as the software that uses advanced mathematics to analyze and learn from data. Examples of AI in convenience include:

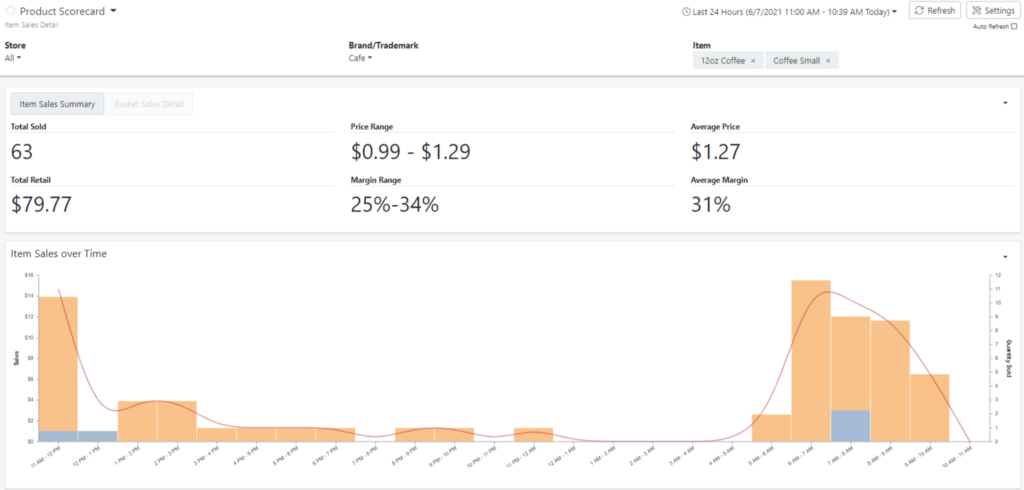

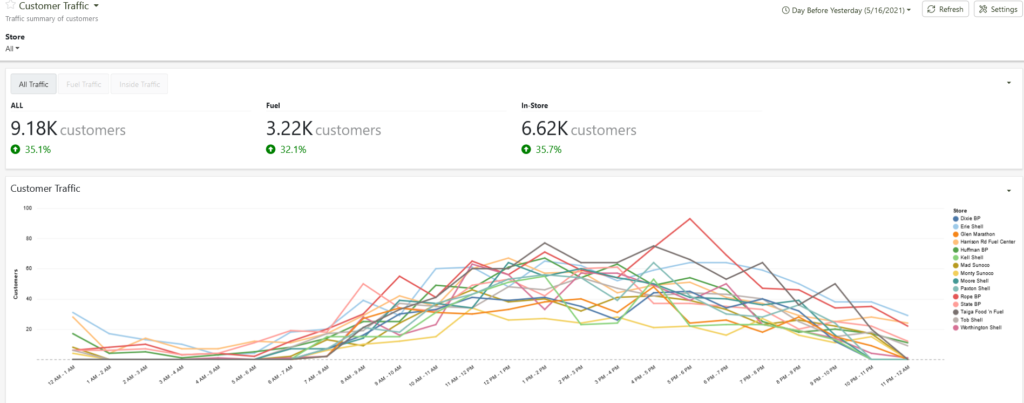

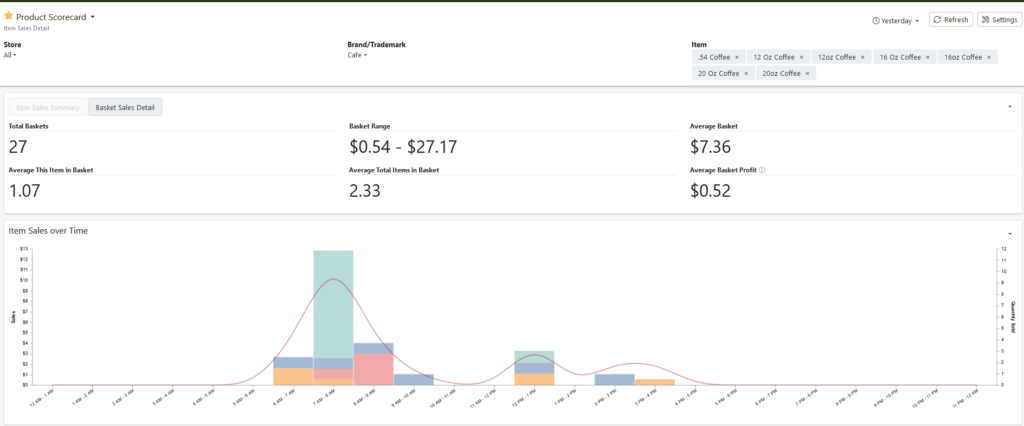

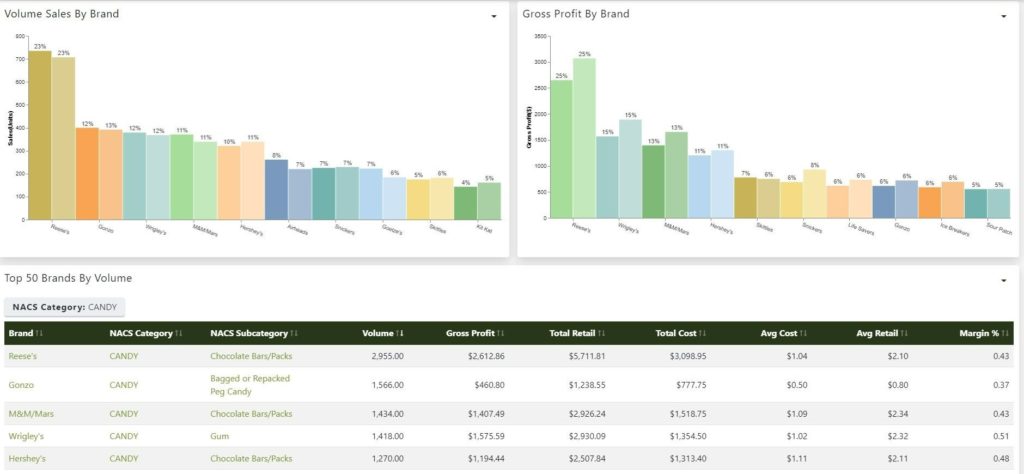

- Automatically categorizing, analyzing, and reporting relevant insights & KPIs to support ops, marketing, merchandising, and store level decisions and action.

- Forecasting and optimizing labor hours and staffing

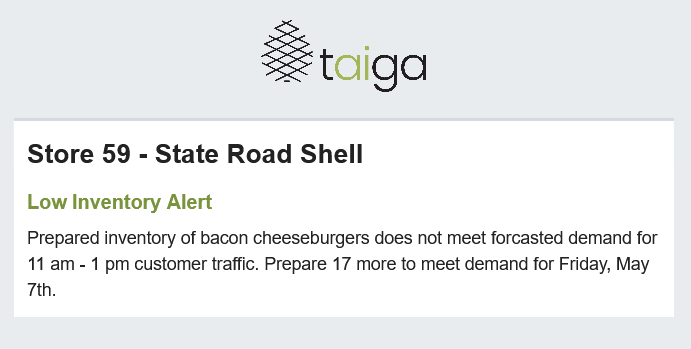

- Predicting an accurate food service forecast to minimize waste and improve margins.

- Identifying unusual transactions to prevent employee theft.

- Receiving a notification to check on a product when the sales have slowed or stopped. This may indicate an obstruction on the shelf or that it’s time to restock.

The idea of technology that could perform these tasks sounds great in theory, but most retailers are well aware of how difficult it is to get accurate and actionable reporting out of their current technology. There is a bigger issue lurking below the surface that needs to be addressed before even thinking about something like AI. I refer to this as the “Big Data Problem” that affects almost every c-store retailer.

What is the “Big Data Problem” and How Do We Solve It?

On average, most stores have at least five different systems in place at each store, everything from ATG to Back Office. It is difficult enough to get two of those systems talking together, let alone a 10-store chain that has a different mix of systems at every store. When it comes to reporting, retailers often rely on someone in their accounting department to write complex SQL queries that run very slowly. It can take hours to get one report on monthly hot dog sales. Then if the management team wants to see a revision, it goes back to the accounting department for even more coding. This problem gets magnified when operators grow through acquisition. The new stores are never on the same systems as your existing portfolio and replacing one back office system with another can take years while being incredibly costly. Who wants to waste time and money replacing systems with equivalent systems when there is already a solution to the Big Data Problem?

Our patented technology platform, StoreKeep, can handle all of the integrations and pulls every single transaction from your stores into a centralized data warehouse in less than three minutes. It’s probably a good time to mention that we have invested years of R&D toward building a solution to the underlying data problem because it doesn’t matter how advanced your AI system is if it doesn’t have high quality data to learn from.

Isn’t My Back Office Already Doing This?

Oftentimes, retailers believe their back-office systems are fully equipped to handle data aggregation for their stores. The reality is that most back-office systems are only pulling a fraction of the POS data from a store on a nightly basis. When we start to examine the data, we see that there is no standard categorization and we often find small differences in the data from store-to-store that can only be resolved by manual clean up. At the end of the day, back-office systems were designed to handle your accounting while StoreKeep was designed for data aggregation and analysis. For many of our clients, StoreKeep works in concert with their back-office by cleaning and structuring their data before they load it in.

The Possibilities Are Endless…

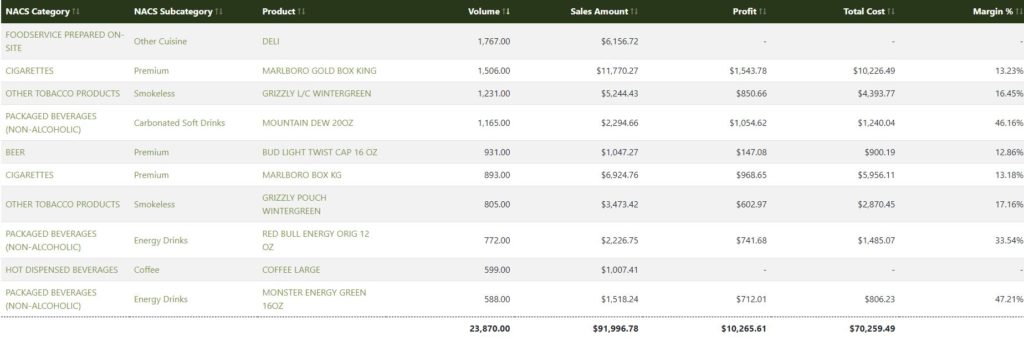

Once your data has been cleaned and stored in the cloud, the next step is to catalog it properly. NACS has created the industry’s Category Definitions and Number Guide which is the framework that we use for cataloging. StoreKeep automatically categorizes data into the NACS Categories as soon as it is uploaded from a store. It is amazing to watch a store’s data that started with just a dozen categories transform into the 200+ categories and subcategories in the NACS standard. Proper categorization increases a retailers ability to analyze their data and compare their performance to industry benchmarks. Proper categorization is also essential for their future plans to adopt AI technology.

What’s Next?

Taiga’s mission is to make AI accessible to every operator whether you have one store or hundreds. Next week, we will focus on some specific examples of how Taiga’s clients are using AI in their day-to-day operations. In the meantime, if you have any questions or comments, please contact me directly. I really believe in the value that StoreKeep delivers to our customers and I would be excited to walk you through a demonstration. Taiga will also be exhibiting at several upcoming industry events and we will be ready to give you a live walk through of StoreKeep if you happen to stop by our booth.

With just 20 minutes, we can demonstrate how easy it would be to transform your business with our simple, yet robust AI solution – just contact us. It will be well worth your time.