In last week’s edition of the New Normal Newsletter, we discussed the movie Moneyball. This movie traces the introduction of “business intelligence” by the Oakland A’s to evaluate players and build their roster. Using better statistics, the A’s were able to identify undervalued players and assemble the historic 2002 team. This team broke the American League winning streak record and won the American League West after starting the season 10 games back. They accomplished this after losing their 3 best players and with a budget was less than 1/3 the Yankee’s. The A’s focus on analytics was so successful that many other teams adopted it, transforming the game of baseball.

Large chains in the convenience store market have been using advanced analytics for a decade. These analytics allow chains to crunch the numbers on the products in stores and gain a market advantage. Using these systems, the large chains optimize product placement, shelf space and pricing to maximize their profitability and capitalize on market trends. Advanced analytics systems create advantages for large chains across the board. Large chains average 11 times greater EBITDA and double in-store sales per square foot ($66.15 vs $32.23) compared with independents. Taiga’s Front Office Platform levels the playing field for Independent convenience store operators. We provide the same type of analytics used by the big chains at affordable prices for independents.

Using Business Intelligence to Maximize the Hard Seltzer Opportunity

In 2020, many rapid changes have made planograms obsolete overnight, but Hard Seltzer has been the champion “planogram destroyer.” This single product category is causing headaches for purchasing departments across the country.

The hard seltzer trend has been so big. In June, Nielsen published an article titled “Hard Seltzer Defies Categorization and Limits as the Most Resilient Alcohol Segment in the U.S.” The complete article can be found at this link, however, the key points are as follows:

- The industry classifies hard seltzer as a Flavored Malt Beverage. However, consumers believe hard seltzer is its own type of beverage.

- Hard seltzer growth has cannibalized other alcoholic beverage sales. This is because a consumer’s alcohol budget and consumption level tend to be fixed. Although alcoholic beverage sales have been up across the board during the pandemic, sell through rates of hard seltzers have increased at the expense of other alcohol categories. Without adjusting inventory to account for the popularity of this new beverage category, operators will continue to lose profits due to stockouts.

- When Nielsen published their article, White Claw and Truly combined for 75% of the hard seltzer market share. At the same time, the growing popularity of this category attracted an array of additional brands. Entering the summer of 2020, there were more than 65 hard seltzer labels. This creates chaoes and ruins more planograms as purchasing departments scramble to determine what to stock.

- Hard seltzer sales have been the most resilient alcoholic beverage category during the pandemic. Retail sales of hard seltzer totaled $3 billion for the 52 week period ending July 3, 2020. This is up 243% from a year earlier according to Bump Williams Consulting Co.

If you are an independent operator, the story of the hard seltzer “planogram destroyer” no doubt rings true, because you have experienced it. But did you ever consider that this “disaster” wasn’t a big problem for the big chains? That big chains actually found hard seltzer to be a great opportunity to increase profit? Next, we describe examples of how Taiga’s Front Office Platform has helped independents keep up with the big chains by delivering real-time localized data analysis to guide their stocking decisions:

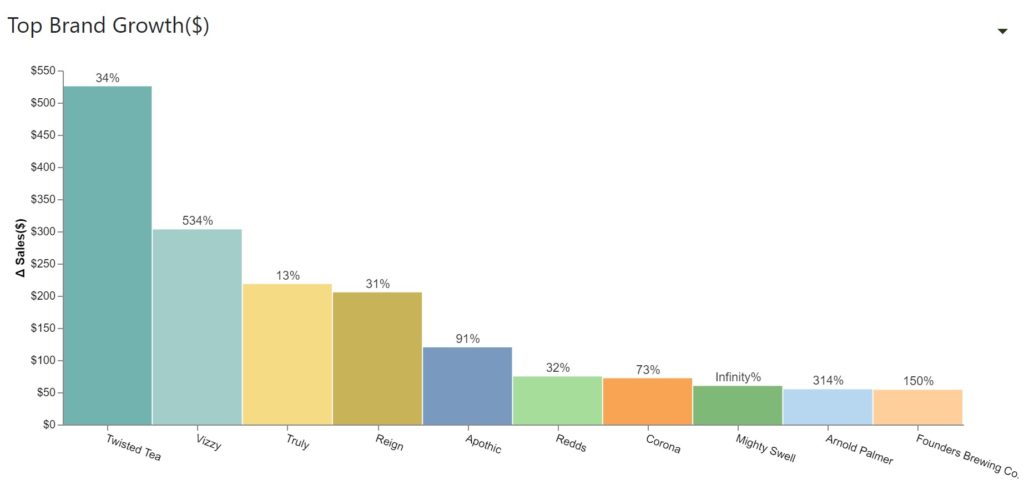

Front Office Platforms Detect New Trends

The spike in consumption of hard seltzer was identified by Taiga in the spring of 2020. Our customers then made adjustments prior to the summer season. Our Front Office Platform also identified increases in craft beer consumption and premium wine sales. These increases were driven by traditional grocery store shoppers as they began to frequent convenience stores.

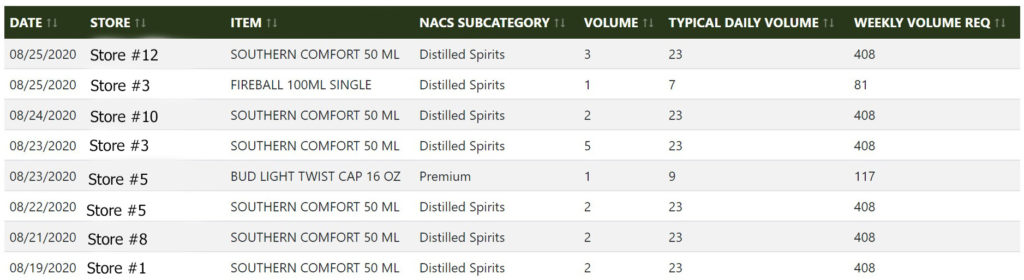

Inventory Alerts

Taiga’s Front Office Platform sends out alerts when it detects a significant change in a product’s sell through rate. These alerts help managers anticipate and prevent stock outs. In the example below, Our Front Office Platform is sending out alerts because it has detected a major decline in a product’s sell through rate. As you can see, the daily volume is below the expected sales.

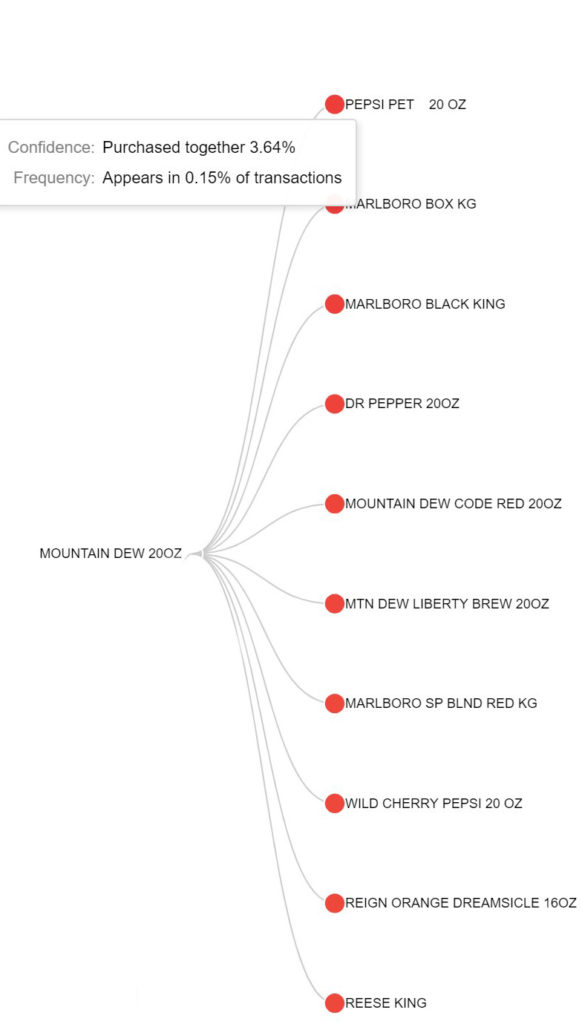

Identifying the Market Basket

Taiga’s Front Office Platform discovers the other products the hard seltzer customer purchases. Managers can strategically place items in the store to increase sales to this customer type and adjust pricing and promotions to increase profitability. Our data suggests that the average basket size of the White Claw buyer is over $20. These customers represent a tremendous opportunity, not only to sell today’s products, but to serve them a mix of products that will keep them coming back.

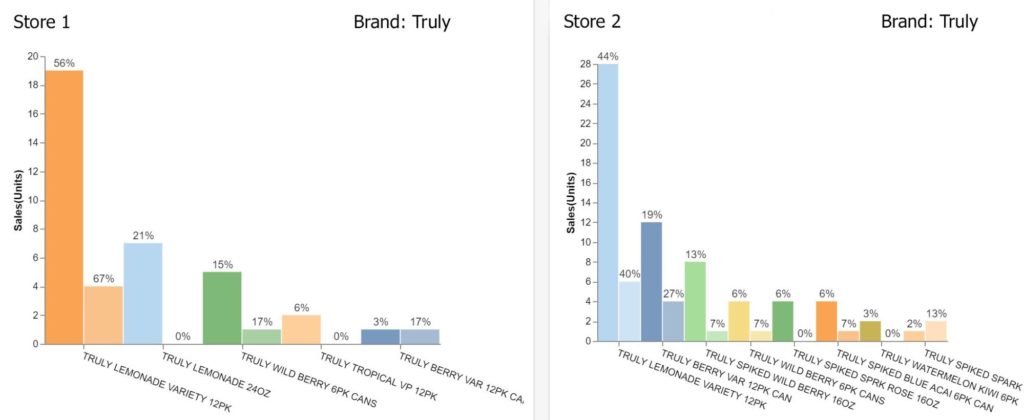

Identifying Localized Demand

Manufacturers provide planograms to help operators place orders (especially of their own products). The data in these planograms is typically based on national averages and is often outdated by months if not years. Taiga’s Front Office Platform generates localized planograms for each unique store, showing actual sales (not national averages) at that store, in real time. Nielsen’s data indicates that a significant majority of the hard seltzer consumers are millennials. Hypothetically, one store may serve primarily an older demographic with an established favorite beer preference. Another store might include a large millennial demographic whose tastes change with the seasons. A real-time, localized planogram allows identification of the unique aspects of each store, allowing immediate adjustment of promotions, pricing, inventory and shelf space accordingly.

Front Office Platforms Help Test New Products

In an article published on July 30, The Wall Street Journal announced that Coca Cola will be launching a hard seltzer beverage under its Topo Chico brand. Coke has not sold alcohol in the United States since closing its wine company in 1983. This launch reflects Coke’s judgement that seltzers have great ongoing potential. Coke plans to pilot the drink in Latin America later this year before launching in the United States.

When the lemon-lime seltzer comes to market, Taiga’s Front Office Platform will be able to track the new product’s success. Our system can also immediately determine how to adjust orders, inventory and shelf space. Those without a Front Office Platform will have to depend on their own intuition about millennial buying habits or on a supplier’s planogram. The big chains won’t have any problem adjusting and taking market share from the independents who lack the insight – the game is rigged.

Evaluation of Promotions

On August 14, 2020 The Chicago Sun Times reported that Spiked Slushies have become the summer’s biggest drink trend. The article reports that both restaurants and home bartenders are combining boozy bases like hard seltzers and beer with mixers and ice to create a variety of new alcoholic slushies. This trend shows an opportuniyy for an independent convenience store chain. The chain could promote a combination of products to make a Mango White Claw Slushie. This promotion would hope to increase the market basket size of the hard seltzer consumer. Taiga’s Front Office Platform could capture real-time data to test the performance of this promotion so it could be rolled out to other stores, or quietly discarded at low cost.

Each of these examples illustrate how a Front Office Platform can inform decision making within an independent convenience store chain to improve bottom line performance. Prior to the introduction of Taiga’s Front Office Platform, installing a system to generate these types of insights was impractical. This impracticality is because the diversity of data sources within independent chains made costs so high they would have been out of reach for independent operators. In developing our Front Office Platform, Taiga has focused on developing a system that is easy to install, capable of handling all data sources, intuitive to use and affordable for the independent operator. Taiga’s Front Office Platform can level the playing field with the big chains, generating real ROI for independent operators.